The article was prepared by Bargen partner Sviatoslav Bartosh and lawyer Alla Melnichenko

Not so long ago, the concept of "corporate agreement" appeared in Ukrainian law. This allowed business owners to settle relations and transfer the so-called "gentleman's agreements" to the legal plane.

We will talk about the opportunities provided by a corporate agreement to business owners in this article.

What is a corporate agreement?

In fact, it is an agreement between the participants of the company on the procedure for doing business. Legally, it is an agreement in which participants determine how they will vote for a decision of the general meeting and how they will act in various situations that may arise in the course of doing business. Next we will tell in more detail and with examples.

Be sure to note that this is an agreement between the participants and it will apply to their rights and obligations, just as members of the company.

What does it mean?

An investor or another person who actually owns the business but is not legally a member of the LLC may not be a party to such an agreement.

Also, a director of a limited liability company cannot be a party to a corporate agreement. That is, in a corporate agreement it is not possible to directly define any rules of conduct of the director of the company or any of his additional responsibilities.

What can be regulated in a corporate agreement?

The law hardly restricts participants in choosing the issues they can regulate in a corporate agreement. It may be:

- the procedure for appointing and dismissing a director of an enterprise or several directors. Participants can agree on the requirements for the candidacy of the director. It can be assumed that one of the participants has the right to choose the candidacy of the executive director, and the other - the financial. You can also agree when the director will be fired;

- delimitation of spheres of influence between participants. In the contract it is possible to fix the decisive right of vote on these or those questions for someone one of participants. You can determine the functionality of each of the participants in doing business - someone is looking for finance, someone is the "face" of the company and is responsible for publicity, someone organizes production processes, etc .;

- algorithms for resolving disputes by participants;

- frequency and order of payment dividends;

- the order of exit of participants from business;

- cases and conditions of sale their share by each of the participants;

- responsibility of participants for breach of their obligations.

You need to be especially careful with the last point. Here is one example when a participant is not serious enough about concluding a corporate agreement:

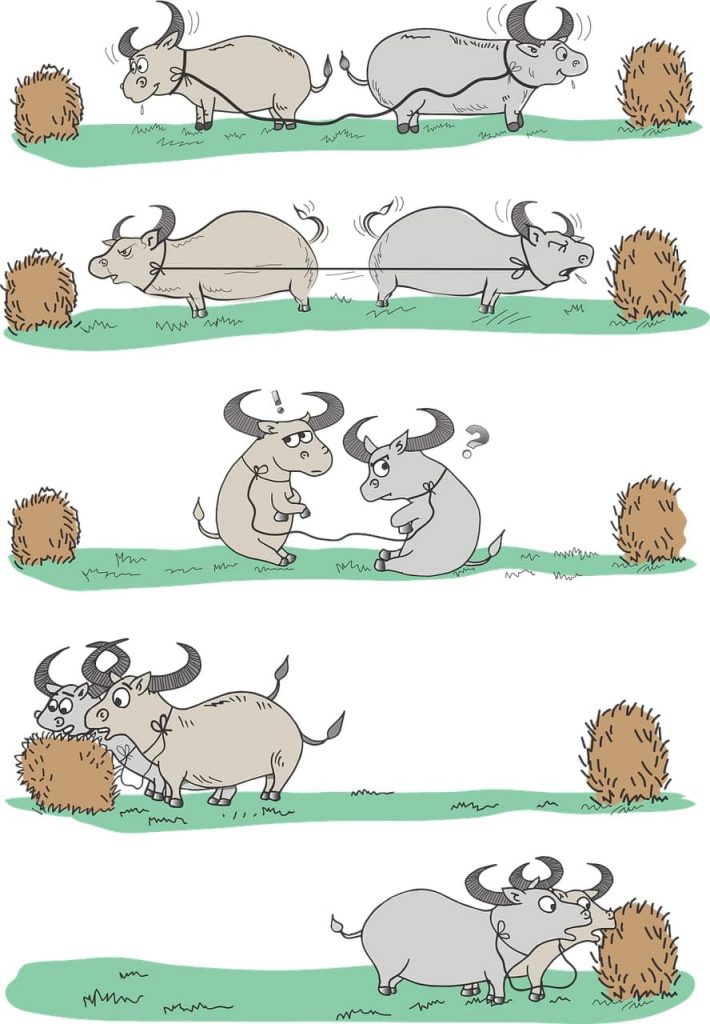

Participant 1 and Participant 2 owned equal shares in several joint ventures that were part of a network of entertainment establishments.

The participants have concluded a corporate agreement regarding these enterprises. In the agreement, they agreed on the procedure and terms of redemption by one of the participants of the share of another participant. During a certain period, Participant 1 has to repay part of the accounts payable on the borrowings of Participant 2, which he took for business development. Participant 1 also had to pay Participant 2 the balance of the value of his share by a certain date. After that, Participant 2 had to sell its share to Participant 1 at face value.

However, the most interesting thing was that the participants in the agreement agreed that if Participant 1 does not make payments within the specified time, then Participant 2 gets the right to a share of Participant 1 to repay the debt.

To ensure the re-issuance of shares, participants issued irrevocable powers of attorney. This is a power of attorney under which the person to whom it is issued can enter into a contract of sale of shares even without the participation of the participant.

It happened exactly as the parties provided in the contract. Participant 1 did not pay the funds within the agreed time. Participant 2 drew up a contract of sale of shares in all companies and received free control over the entire group of companies.

Participant 1 later tried to invalidate the contract in court, but the court confirmed that such terms of the contract are perfectly legal (decision of the Commercial Court of Odessa region from 11/28/2019).

This example shows that the conclusion of corporate agreements should be approached carefully. An ill-considered clause in the contract and instead of avoiding conflicts in the process of doing business together, you can be left without a business at all.

What can be regulated in a corporate agreement?

Confidentiality. Perhaps the biggest advantage of corporate agreements is their confidentiality. The terms of a corporate agreement are known only to the parties to such agreements, in contrast to the provisions of the charter, which are open.

Ability to record agreements in a document that will have legal force. In the charter, participants can not always set out all their agreements reached during the establishment of the enterprise. In addition, if such arrangements change in the future, it is inconvenient to amend the statutes each time. The corporate agreement can be concluded at any time, supplemented or terminated. Only participants will know about it.

What can be regulated in a corporate agreement?

Only participants can be parties. In our reality, not all business owners are ready to formalize their status as a member of the company. For such "secret owners" a corporate agreement is not available.

Limited liability for breach of contract. The corporate agreement may provide for the obligation of the participant to vote for certain decisions at the general meeting. However, there is no effective mechanism to force a participant to comply with this obligation. An effective measure of liability is the mandatory sale of a participant's share. However, it is not advisable to establish such strict liability for every minor violation.

Conclusions

The ability to enter into corporate agreements can significantly improve relations between business partners, prevent conflicts or prevent the blocking of the enterprise due to the lack of a common position between the owners.

At the same time, the conclusion of such agreements should be approached thoughtfully. Insufficient attention to the provisions of the corporate agreement can lead to the loss of business by one of the participants. Entrust the work on such contracts to professionals.

If you need advice on developing a corporate agreement, contact us for help

(Number of ratings: 11 average: 5.00 of 5)

(Number of ratings: 11 average: 5.00 of 5)